THE BACKBONE OF YOUR ORGANIZATION’S FINANCES

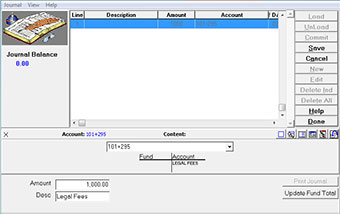

Pro Fund Accounting’s General Ledger software is designed for speed, simplicity and accuracy alike. Here’s how we accomplished that.

First, our General Ledger software is split into two parts for easy organization – Maintenance and Posting. Maintenance is for creating account numbers , assigning titles, setting up fiscal years and more. Posting is, obviously, for posting journal entries for cash receipts, accounts payable, payroll, fund transfers, utility billing and more.

Through the intense and precise structuring of our software, you can be certain that your General Ledger will always stay in balance, no matter how simple or complex your entries are. We’ve also enabled our software to set up new accounts “on the fly” – without having to exit or switch windows! You’ll also be able to quickly and easily check which funds need entries in order for an account to balance. Printing is also a breeze, too!

For those with an extensive or complex chart of accounts, we support up to seven levels of multi-segmented accounts.

Oh, and with our General Ledger Budgeting feature, you can create “empty budgets” for selected account types to post in later. This way, one person can set up the budget for another person to post in.

Finally, you’ll be able to create budget worksheets easily and post any adjustments to the figures, so you can repair inadequate budgets immediately. General Ledger Budgeting also supports creating budgets for an upcoming fiscal year – so it’s perfect for forecasting.

General Ledger Features

- Duplicate account numbers from one fund to another

- No need to close out one month before starting work on the next month

- Post budgets and adjustments

- Multiple cash accounts per fund

- Budget adjustments “on the fly”

- Detailed transaction records

- Full range of financial and budget reports

- Scores of reports designed specifically for auditor use

- Save printing options for any report

- Context-sensitive help with the press of a button